XRechnung explained: structure, fields, mandatory information

Digitalization has fundamentally changed the way companies and public institutions operate. A key component of this transformation was (and still is) the introduction of electronic invoicing (also known as eInvoicing) in the form of XRechnung in Germany.

This electronic invoice format considerably simplifies the invoicing process between companies of all sizes and enables business transactions to be processed more efficiently - previously this only applied to the exchange of invoices with the public sector (B2G).

In this article, we will take an in-depth look at the XRechnung format and explain what it is, who uses it, how it is structured and what information it contains.

Do you want to become an XRechnung expert? Then hold on tight, here we go!

What is the XRechnung?

XRechnung is a standardized format for electronic invoices. It was developed to create a uniform standard for electronic invoicing, particularly for public clients in Germany. In contrast to conventional paper invoices or simple PDF invoices, XRechnung is a structured XML data format. This structuring enables automated and efficient processing of invoice data.

Who can use XRechnung - and who can't?

The primary target group for XRechnung are public clients and their suppliers. Since November 2020, public clients of the federal government have been obliged to receive and process invoices in this format. This requirement is the result of an EU directive that stipulates the introduction of electronic invoicing procedures in public administration. For small and medium-sized enterprises and IT experts, XRechnung offers the advantage that it can be processed automatically, saving time and resources.

How is the XRechnung structured?

An XRechnung consists of various mandatory and optional fields.

Mandatory fields in the XRechnung

The mandatory fields include information such as the invoicing party, invoice recipient, invoice date, invoice number, terms of payment and the description of the goods or services supplied.

Optional fields in the XInvoice

Optional fields can contain discounts, tax information or additional references. The structure of the XRechnung follows a specific schema that ensures compliance with the standard and enables seamless integration into existing accounting systems.

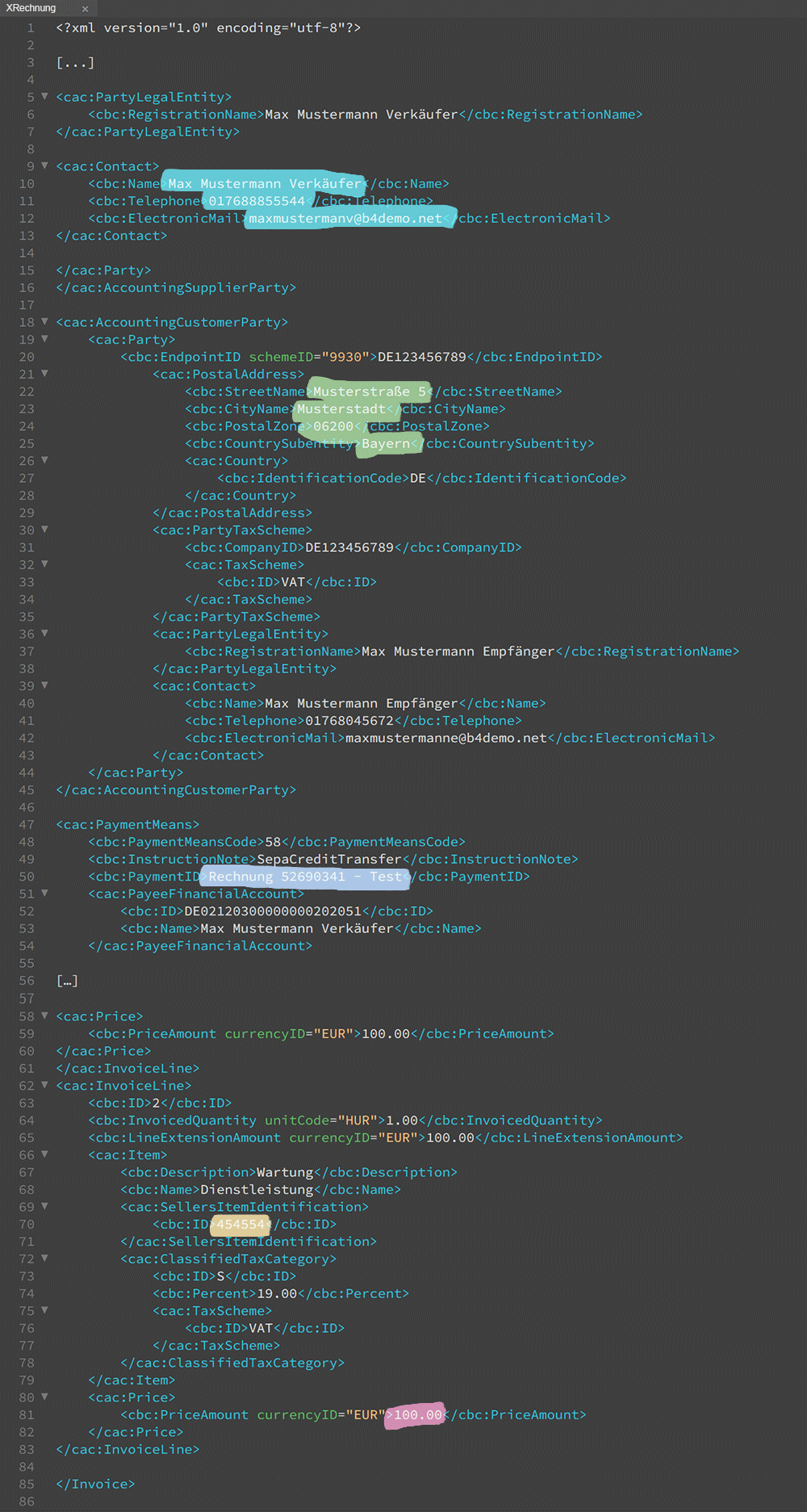

The XRechnung in pure XML format looks like this (excerpt):

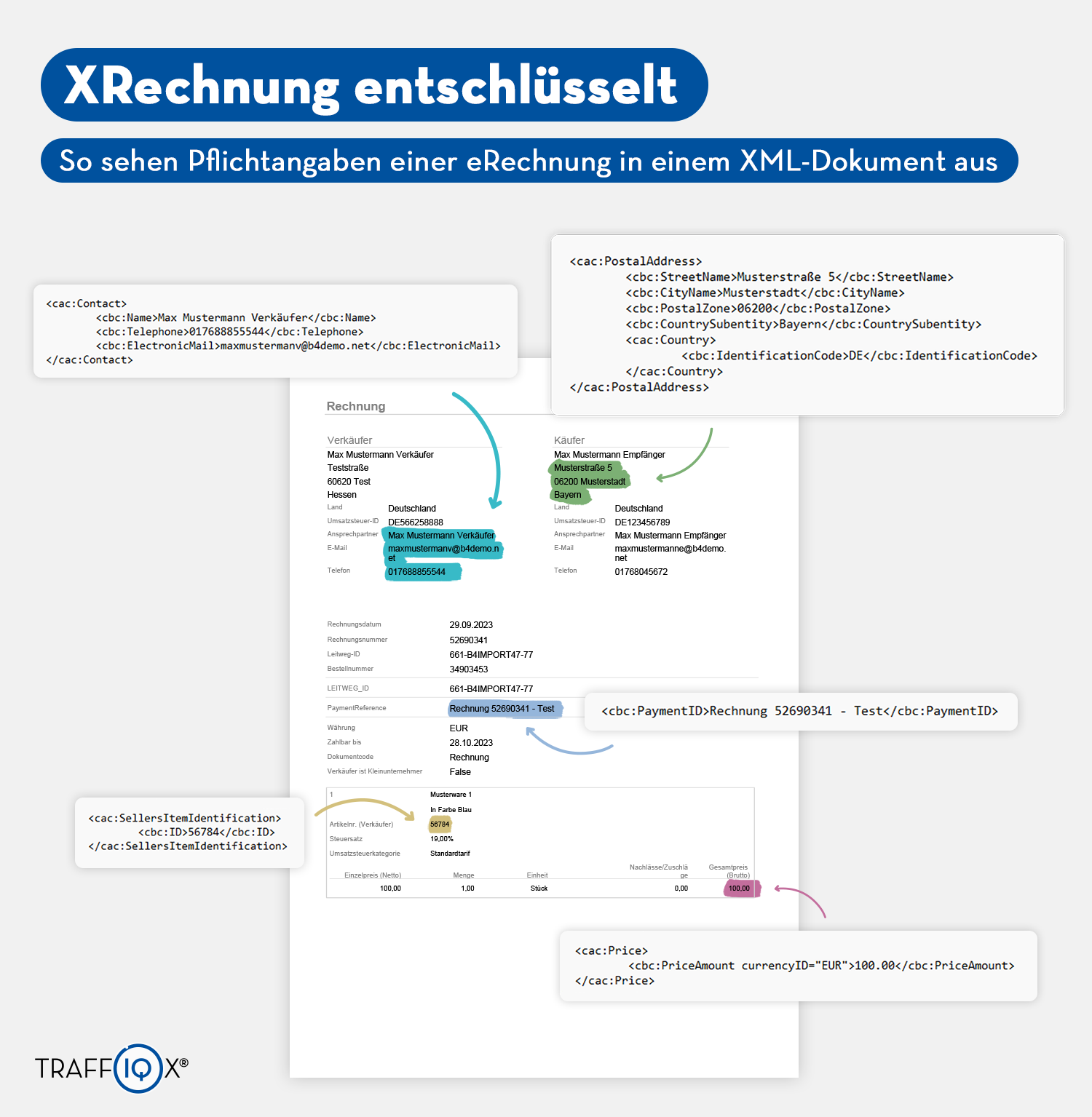

But where can you find the various mandatory details in the XML document, as we know them from a “classic” paper or PDF invoice? We hope that the following visualization will shed some light on this. Because here we have illustrated the whole thing graphically and linked it visually with the corresponding references from the preceding XML code.

Practical handling and reading of an XRechnung

It doesn't actually look that complicated, does it? However, there is one small drawback. Unfortunately, an XML data set is nowhere near as easy to visualize in practice as in our example.

In order to read an XRechnung, you generally need appropriate software that can interpret the XML format. Some accounting and ERP systems are already capable of processing the XRechnung format directly. However, the vast majority of currently available industry, administration and accounting solutions for small and medium-sized companies, the skilled trades, many service providers and other specialist providers are lagging far behind.

However, it is particularly important for small and medium-sized companies and public administrations to use systems that enable smooth processing and archiving of XRechnung invoices - and other permitted standards such as ZUGFeRD. Appropriate interfaces to specialized eInvoicing service providers therefore play a key role, enabling the smooth conversion of invoice data into the required formats and their targeted delivery or receipt and further processing in existing ERP systems.

Another advantage of this “division of labor” is that the digital service providers - from the TRAFFIQX® network, for example - ensure that everything is always up to date with a whole army of digital specialists.

Staying up to date - a life task?!

With several hundred eInvoicing standards worldwide, all of which undergo regular version updates, enhancements, adaptations and clarifications, simply “keeping track” can be quite a mammoth task. It's a good thing that there are specialized eInvoicing networks like TRAFFIQX® that do just that - and allow their network members to concentrate on “more important things”.

Sounds like a lot of work? It is!

But that's why we exist, probably the most successful e-invoicing network for your electronic invoice exchange - not only with XRechnung, but with almost all common national and international e-invoicing standards. And it's fast, simple and extremely cost-efficient.