eInvoices and legally required information: Recognizing and avoiding errors in electronic invoices

Invoices are an integral part of every business - and almost every entrepreneur is familiar with their legally required details. But in 2025, everything will be a little more complicated: with the introduction of mandatory e-invoicing, this information must not only be correct, but must also be available in a standardized, structured electronic format in accordance with EN 16931. In contrast to paper invoices or simple PDFs, this makes automated processing significantly faster, simpler and less error-prone. But how exactly does this work?

Mandatory information and mandatory fields: The path to error-free eInvoicing for companies

Suddenly, companies are faced with questions such as: What exactly should be included in an invoice so that it complies with tax regulations? And: How do you translate this information into the structured fields (BT fields) of an eInvoice? In this article, we provide answers - and explain what else you need to bear in mind so that your eInvoices are not rejected by the recipient or later by the tax office.

Mandatory legal information: The basis of every invoice in all formats

According to Section 14 of the German Value Added Tax Act (UStG), invoices in Germany must contain certain mandatory information in order to be valid for tax purposes. Here are the most important requirements:

- Name and address of invoicing party and invoice recipient

- Invoice number: A consecutive, unique number is required

- Invoice date: The issue date of the invoice is also one of the mandatory details

- Quantity and type of goods or services supplied to the recipient

- Time of delivery or provision of service

- Remuneration (net amount), broken down by tax rates

- VAT amount or reference to tax exemption (e.g. according to § 19 UStG)

- Applicable VAT rate

- Tax number or VAT ID number of the issuing company

This information is already essential on traditional paper invoices. But how do you transfer this information to the world of e-invoicing?

Mandatory information and its BT fields for electronic invoicing

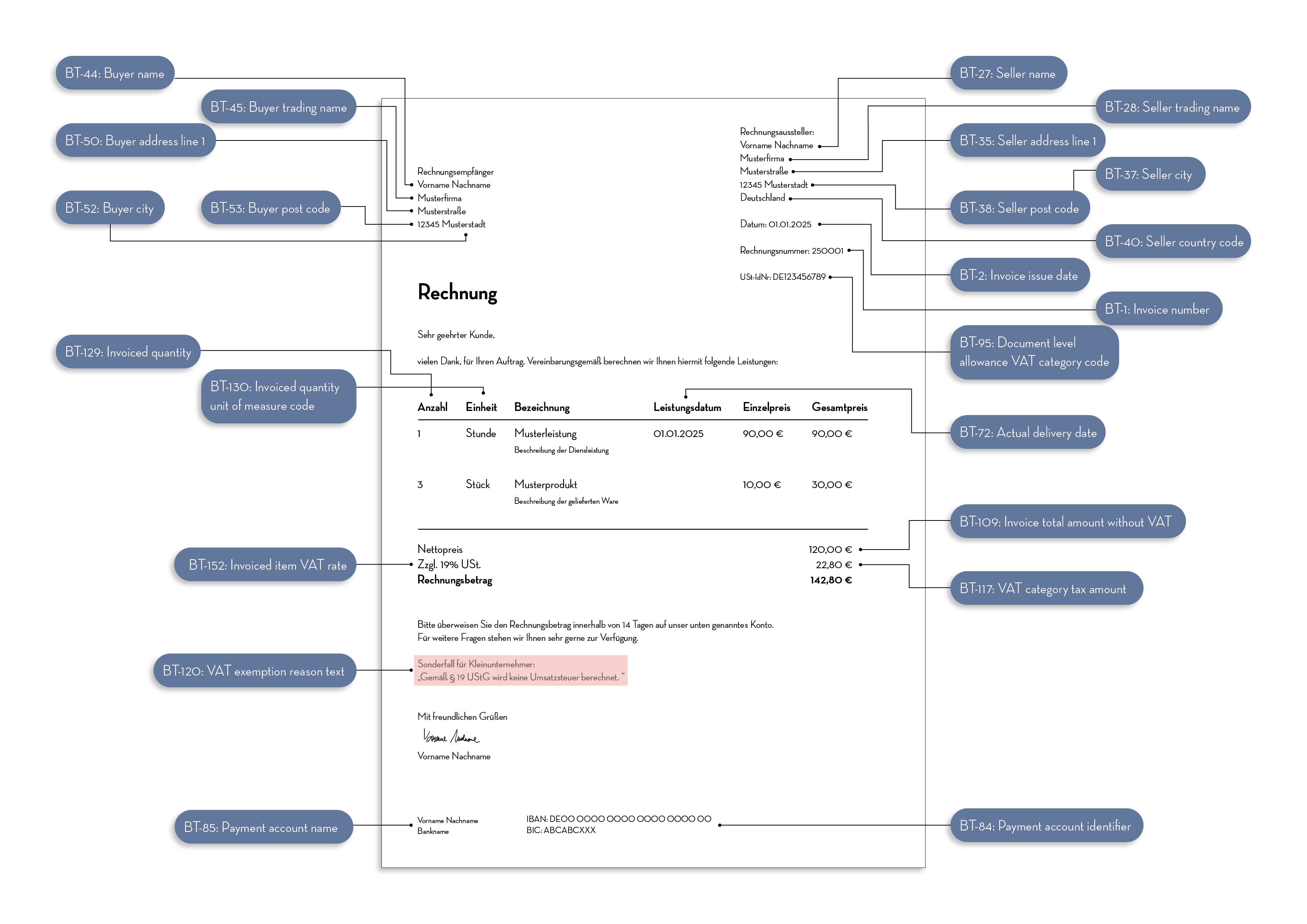

In an eInvoice, the above-mentioned mandatory information is not simply displayed as text, but translated into structured data fields - the so-called BT fields (Business Terms). These fields ensure that the invoice is machine-readable and can be processed automatically.

One example:

- The invoice number is always entered in the BT-1 field for electronic invoices structured in accordance with the CEN standard.

- The invoice date ends up in BT-2 during electronic invoicing.

- The total amount without VAT should be entered in field BT-109 in electronic format.

To make this assignment clearer, we have created a practical infographic that shows how the most important tax-relevant mandatory information must be translated into the most important BT fields provided for this purpose:

A small drop of bitterness: Unfortunately, this is only the absolute tip of the mandatory fields iceberg. The other fields and individual details, rules etc. that may be relevant for your e-invoices can be found at the end of this article in much more detail.

Why BT fields are not everything: Consistency and logic in electronic invoicing

Simply filling in the BT fields is not enough for an e-invoice. In addition to the mandatory fields, every electronic invoice must comply with the so-called BR rules (Business Rules). These rules ensure that the invoice is not only complete, but also logically consistent and error-free.

What are BR rules and what role do they play in electronic invoices?

BR rules are logical checking mechanisms that ensure that the data in the invoice is correct in terms of content and calculation. They are based on international standards such as the European Standard (EN) 16931, which specifies how an electronic invoice must be structured so that it can be processed automatically by software solutions.

Typical BR checks include:

- Mathematical consistency: Do the individual items agree with the subtotals and the grand total? Errors when calculating totals - such as rounding differences - immediately lead to rejection in an electronic invoice.

- Completeness of data: Are all mandatory fields (e.g. BT-1 to BT-152) filled in correctly and completely? If an invoice date or tax number is missing, for example, an invoice was not accepted even before the eRechnung 2025 obligation. Provided the error was noticed in time.

- Correctness of tax rates and tax amounts: Have the correct tax rates been applied and do they match the tax amounts stated? A common problem: the tax rate is stated as 19 percent, but the calculated tax amount is 16 percent. Such errors often go unnoticed in traditional paper invoices, but inevitably lead to a rejection if incorrectly issued e-invoices are transmitted and/or received.

Additional relevant checks by BR rules:

- Logical links between fields: Do the specified service data (e.g. delivery date in BT-72) match the invoice amounts and the total amount?

- Consistency of currencies and units of measurement: Is the same currency (BT-5) or unit of measurement (BT-130) used throughout?

- Validity of codes: Do the fields such as BT-55 (buyer's country code) or BT-84 (IBAN) contain valid and standard-compliant values? Invalid or unauthorized codes lead to problems with machine processing.

- Formal requirements for free text fields: Texts in optional fields such as BT-22 (Invoice note) or BT-127 (Invoice line note) may only have the permitted number of characters and must be formatted so that they do not interfere with processing.

A practical example: If an invoice specifies the tax rate of 19 percent, but the tax amount is not multiplied by the net amount or is inaccurate due to rounding, the invoice is automatically rejected. Such errors are often caused by manual input or incorrect rounding logic. While a classic paper invoice could still be accepted due to human indulgence, machine validation recognizes such deviations immediately and blocks processing.

BR rules aim to increase the quality and reliability of invoice data. This ensures that invoices run smoothly through automated systems - both at the recipient's end and at verification offices such as tax offices. They also minimize the time and effort required for queries and corrections, which often occur with incorrect paper invoices.

The most common sources of error with eInvoices

eInvoices offer many advantages, but also increase complexity. Here are some typical mistakes that can lead to a rejection:

- Incomplete mandatory fields: Even a missing zip code can be problematic.

- Incorrect logic: errors in the totals or contradictory information.

- Incorrect format: Invoices must be in standard XRechnung or ZUGFeRD. A PDF is not sufficient.

- Incorrect transmission: Data can be lost, especially if different transmission channels (e.g. PEPPOL, e-mail or ZRE) are used manually or only partially automated.

Practical tips for the start of the 2025 obligation: receiving and sending error-free e-invoices

To ensure that your eInvoices are not rejected, you should note the following points:

- Use specialized software or a service like TRAFFIQX® to check, convert and send your invoices.

- Check whether your invoices comply with all relevant BT fields and BR rules.

- Make sure you use the correct format and the correct transmission path.

The TRAFFIQX® network supports you in implementing the new requirements smoothly. Our experienced eInvoice providers automatically check every invoice for completeness and logic, convert it into the required format and ensure error-free delivery.

Sounds exciting?

Find out more about electronic document exchange with TRAFFIQX® here!

(Not only statutory) mandatory fields in electronic invoices

Basic mandatory fields to comply with the legal requirements from 2025

These fields contain the essential information that every invoice must contain in order to be valid for tax purposes.

Every invoice requires a unique, consecutive number. This number is used for the traceability and identification of the invoice, both for the recipient and for tax audits. The number may not be assigned twice and must be logically anchored in the issuer's system.

The date on which the invoice was created. It forms the basis for deadlines, such as payment terms, and is used for tax allocation. Important: The invoice date may not be changed retrospectively.

The full legal name of the company or person issuing the invoice. This is necessary in order to clearly assign the invoice to the issuer.

If the issuer operates under a trade name that differs from the legal name, this should be stated here. This makes it easier for the recipient to identify the issuer.

The first line of the invoice issuer's address. This should contain the street and house number to enable a physical assignment.

The city in which the invoice issuer is located. Indispensable information for the complete address.

The postal code of the invoice issuer. It supplements the address details and is necessary for correct delivery.

The two-digit ISO country code that indicates the country of origin of the invoice issuer. For example, “DE” for Germany.

Mandatory fields for the invoice recipient or the invoice-receiving company

These fields contain the information required to assign the invoice to the correct recipient.

The full name of the person or organization receiving the invoice. Important to be able to clearly assign the invoice to the recipient.

If the recipient uses a trade name that differs from the legal name, this should be entered here. This makes communication easier for the invoice issuer.

The street and house number of the recipient's address. A complete address is essential for traceability.

The city in which the recipient of the invoice is located.

The zip code of the invoice recipient. It supplements the address details for precise allocation.

Mandatory fields for tax details and invoice content

These fields ensure that all details for the tax statement are correct and traceable.

If the delivery or service takes place on a date other than the invoice date, this must be entered here. It is important for the correct tax period.

The total amount of the invoice, calculated from the net amounts of the individual items. This value serves as the basis for the tax calculation.

The tax amount calculated from the net amount. This amount must be consistent with the specified tax rate.

If a tax exemption applies, the legal reason must be stated here, e.g. “Small business regulation according to § 19 UStG”.

The number of units that have been delivered or provided. This helps the recipient to reconcile the invoice with the products or services received.

The unit of measurement, e.g. piece, kilogram or hour. This ensures clarity, especially for differentiated services.

The tax rate to be applied to the invoice, e.g. 19 percent or 7 percent. The tax rate must comply with the current statutory regulations.

Payment details

These fields are optional, but recommended as they facilitate the payment process.

The IBAN of the payment account to which the amount is to be transferred. This information is optional, but very helpful for the recipient.

The name of the account holder to whose account the payment is to be made. This provides additional clarity.

Other important BT fields in XRechnung, ZUGFeRD and other EN 16931-compatible e-invoice formats

In addition to the mandatory fields mentioned above, there are specific fields for XRechnung and ZUGFeRD, such as BT-9: Payment due date or BT-31: Seller VAT identifier (VAT ID of the seller). This extended information is particularly relevant for transactions with public clients or more complex B2B transactions.

Defines the type of invoice, e.g. “Invoice”, “Credit note” or “Cancellation invoice”.

The currency of the invoice, e.g. “EUR” for euros. This information is particularly important for cross-border invoices.

The date by which the invoice must be paid. Analogous to XInvoice.

A reference number of the invoice recipient that is used for internal processing of the invoice by the buyer. Often required by public clients.

The number of the order to which the invoice relates. This makes it easier for the buyer to assign the invoice.

Details of the agreed payment terms or modalities, e.g. discount periods or different payment terms.

Free text field for additional notes on the invoice that cannot be accommodated in other fields.

A unique identification code of the invoice issuer, e.g. a national tax or commercial register number.

The sales tax identification number of the seller, required for tax purposes.

Specification of a contact person on the part of the invoice issuer for queries regarding the invoice.

Telephone number of the contact person at the seller.

E-mail address of the contact person for electronic queries.

If available, the VAT identification number of the invoice recipient.

The two-digit ISO country code of the buyer, e.g. “DE” for Germany.

The contact person on the invoice recipient's side, if required for allocation or clarification.

The telephone number of the contact person on the recipient's side.

E-mail address of the recipient's contact person.

If the invoice relates to a period, the start date is specified here.

The end date of the billing period.

Description of the payment method, e.g. “bank transfer” or “direct debit”.

If a payment service provider is used, its identification number can be entered here.

If direct debit is used, the mandate reference is given.

A unique identification number of the invoice issuer assigned by the bank.

The IBAN of the debited account for direct debits.

The tax rate to be applied to discounts granted.

The reason why a discount or deduction was granted.

The total amount for additional fees or surcharges.

The tax rate to be applied to additional fees or surcharges.

Justification for surcharges levied.

The amount of sales tax charged on the invoice.

The gross amount of the invoice, i.e. the sum of the net amounts plus VAT.

The final amount to be paid after discounts and surcharges have been taken into account.

The net amount used for the tax calculation.

A unique identifier that identifies each invoice item.

Additional information or descriptions for an invoice item.

The net price per unit for an invoice item.

A precise description of the products delivered or services provided.

Sounds like action is needed soon? That's right!

But that's why we exist, probably the most successful e-invoicing network for your electronic invoice exchange - not only in Germany, but throughout Europe and the world. And it's fast, simple and extremely cost-efficient.

Want to find out more? Arrange a free consultation with our expert Lars Becher, Key Account Manager and Subject Matter Expert for eInvoicing and CTC in the TRAFFIQX® network.